CMN Markets July 2021 | CRISPR Stocks and Market News

The CMN Markets Newsletter will bring you the latest news updates from the stock markets with focus on companies that have clinical-stage programmes involving a gene-editing tool like CRISPR.

Highlights

- Caribou Biosciences (NASDAQ:CRBU) completes initial public offering.

- Prime Medicine launches as new player with $315M to revolutionise gene editing.

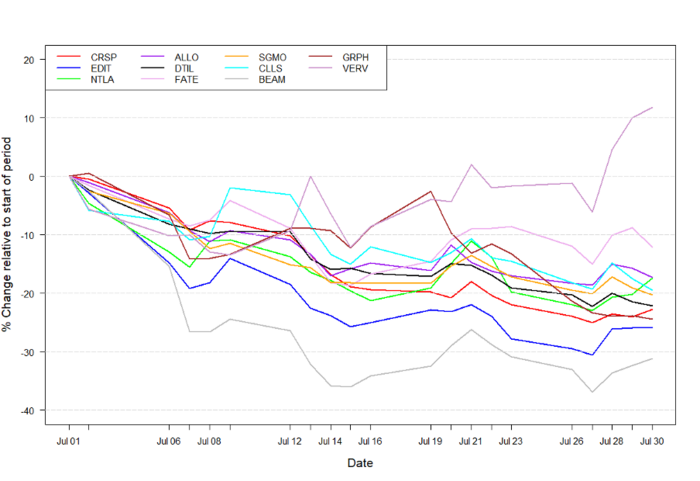

Figure 1: Data on stock performance shown from July 1st to August 1st. Data from Yahoo Finance. Companies: CRISPR Therapeutics (CRSP), Allogene Therapeutics (Allo), Sangamo Therapeutics (SGMO), Editas Medicine (EDIT), Precision Biosciences (DTIL), Cellectis (CLLS), Intellia Therapeutics (NTLA), Fate Therapeutics (FATE), Beam Therapeutics (BEAM), Verve Therapeutics (VERV), Graphite Bio (GRPH).

Influences from the broader economic trends

The stock market, and especially the growth stocks, has seen a healthy increase since May, and June saw many new highs for gene-editing companies such as Intellia Therapeutics (NASDAQ:NTLA). However, stocks started tumbling after inflation data surprised financial analysts and investors on June 13th, seeing an increase in the consumer price index of 5.4% year over year in the month of June, and an increase of 0.9% month over month from May to June, up from a month over month increase of 0.6% from April to May. Speaking about June inflation data, Gennadiy Goldberg, interest rate strategist at TD Securities said: »There is certainly some concern that some of these price increases are coming in much quicker than expected, but you can argue that a lot of this is due to the recovery.« Here, Goldberg connects the rise in inflation to the ongoing reopening of society after the COVID-19 crisis, supporting the notion that inflation will be transitory and will pass alongside the reopening, which is also the viewpoint of Federal Reserve chairman Jerome Powell.

Financial results

CRISPR Therapeutics Q2 2021 earnings

CRISPR Therapeutics reported its Q2 earnings from 2021 on July 30th. Financial analysts estimated an earnings per share (EPS) of $4.19, but CRISPR Therapeutics beat expectations, reporting an EPS of $9.44 by a margin of 125.3%. This is much better than the companies Q1 financials of 2021, where it reported a miss of EPS of -2.7%.

New deals in the gene-editing space

Caribou Biosciences completes initial public offering

Caribou Biosciences completed its initial public offering (IPO) on the Nasdaq Global Select Market under the ticker NASDAQ:CRBU to raise $304M at an initial price of $16 per share. The company is the latest CRISPR-oriented company to file for an IPO, after Verve Therapeutics (NASDAQ:VERV) and Graphite Bio (NASDAQ:GRPH) went public during June. Caribou primarily focuses on the development of next generation CAR T and CAR-NK cell therapies, and the company already has one programme being tested in clinical trials: the CB-010 programme which is an allogeneic CD19-targeting CAR T-cell therapy with TRAC and PD-1 knockout.

The stock performance of Caribou Biosciences will be included in the CMN Markets graph from August 2021 and onwards.

Intellia Therapeutics announces public stock offering

On July 2nd Intellia Therapeutics announced the closing of a public offering of its common stock. The company offered 4,758,620 shares at an underwritten price of $145.00 per share. The gross proceeds that the company earned from the public stock offering is estimated at $690 million,ecuring the company a lot of cash on hand for further studies.

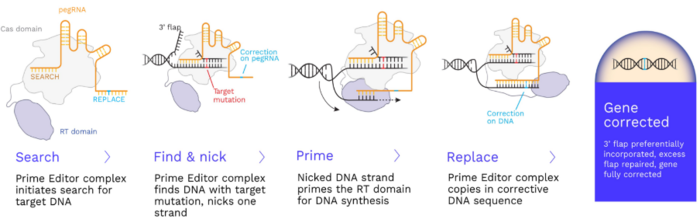

Prime Medicine enters the scene

On July 13th Prime Medicine announced that it had launched with financing of $315 million. The company is focused on delivering on the promise of prime editing and is pioneering true search and replace technology in order to restore and cure genetic mutations and diseases. The company received an initial Series A investment of $115 million and was supplemented with a Series B investment of $200 million. Figure 2 depicts the mechanism by which prime editing technology works, differentiating it from canonical CRISPR-Cas9 gene editing and base editing. Andrew Anzelone, scientific co-founder of Prime Medicine, previously spoke about the potential of the technology in an interview with CMN.

Summer spotlight

In June, Graphite Biosciences completed its initial public offering and official entry into the Nasdaq and stock market. CRISPR Medicine News has covered Graphite Bio’s developments in the gene-editing space for sickle cell disease and beta-thalassemia with interviews here and here.

What to look out for in August

Many of the gene-editing companies featured in CMN Markets will report their Q2 earnings from 2021 in August. CRISPR Therapeutics has already announced Q2 earnings, but we have yet to see financial results from companies like Beam Therapeutics, Precision Biosciences, Editas Medicine and more.

Disclaimer: None of the information given above should be considered investment advice. The authors or CRISPR Medicine News cannot be held accountable for any losses associated with investing in the companies discussed.