CMN Markets March 2022 | CRISPR Stocks and Market News

The CMN Markets Newsletter will bring you the latest news updates from the stock markets with focus on companies that have clinical-stage programmes involving a gene-editing tool like CRISPR.

Highlights

- Global financial and geopolitical events put pressure on markets.

- Intellia Therapeutics doses first patient and receives orphan drug designation for its ex vivo candidate NTLA-5001 for acute myeloid leukaemia.

- Financial updates provided by multiple companies.

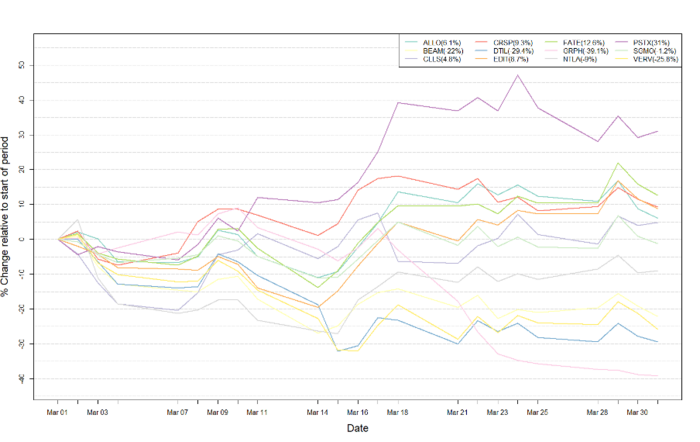

Figure 1: Data on stock performance shown from March 1st to March 31st 2022. Data from Yahoo Finance. Companies: CRISPR Therapeutics (CRSP), Allogene Therapeutics (ALLO), Sangamo Therapeutics (SGMO), Editas Medicine (EDIT), Precision Biosciences (DTIL), Cellectis (CLLS), Intellia Therapeutics (NTLA), Fate Therapeutics (FATE), Beam Therapeutics (BEAM), Verve Therapeutics (VERV), Graphite Bio (GRPH), Poseida Therapeutics (PSTX).

Influences from the broader economic trends

March has brought both ups and downs for the general markets, as they continue to digest the multitude of global financial and geopolitical events and outlooks currently transpiring in 2022. For the first half of March, markets continued their declines as worries around the economic impacts of the Russian invasion of Ukraine continued to grow. Following concerns about an energy crisis, markets watched as oil prices grew to highs not seen since 2008, and the overall implications of the implemented western sanctions against Russia were still being discussed. Chris Rupkey, chief economist at FWDBONDS spoke on the economy and the invasion saying: >>The inflation fire was already hot and now with war-driven inflation added to the mix, it will grow even hotter.<< Additionally, The American Federal Reserve ruled to raise interest rates by 0.25% on March 16th, the first rate hike since the economic housing crisis of 2008. In the Federal Reserve official meeting, it noted: >>The invasion of Ukraine by Russia is causing tremendous human and economic hardship. The implications for the U.S. economy are highly uncertain, but in the near term [it] is likely to create additional upward pressure on inflation.<< Markets seemed to react favourably to the federal reserve raising rates by the projected rate, and markets proceeded on a steady uptrend for the second half of March.

Data influencing stock movements

Intellia Therapeutics receives orphan drug designation for NTLA-5001 and doses the first patient in Phase 1/2 trial

On March 9th, the FDA granted Intellia Therapeutics (NASDAQ:NTLA) orphan drug designation status for the company’s ex vivo T-cell receptor (TCR) therapy, NTLA-5001, for the treatment of acute myeloid leukaemia (AML). On March 1stIntellia announced that the company had dosed the first patient in the Phase 1/2a trial to evaluate the safety and tolerability of the CRISPR-Cas9 based TCR therapy, as well as the anti-tumour effects, through a single dose. Future plans for this clinical study include dose-escalation separated into two independent arms. Arm 1 will evaluate NTLA-5001 in adults with lower burden AML while arm 2 will evaluate the candidate in adults with higher disease burden, defined as patients with >=5% blasts in bone marrow.

Allogene Therapeutics receives FDA fast track designation for its first solid tumour candidate

Allogene Therapeutics (NASDAQ:ALLO) announced on March 10th, that the FDA had granted fast track designation for the company’s first solid tumour candidate, ALLO-316. ALLO-316 is an allogeneic CAR-T solid tumour candidate designed to treat patients suffering from advanced or metastatic clear cell renal cell carcinoma (RCC). RCC is historically difficult to treat, and the five year survival rate of patients suffering from advanced kidney cancer is only 15%. ALLO-316 is designed to target the cell surface marker CD70, which is heavily expressed in RCC. As CD70 is selectively expressed in several cancers besides RCC, ALLO-316 is a potential candidate for expansion in other cancer indications.

Financial results from third quarter (Q4) of 2021 and full year reports

Caribou Biosciences

On March 21st, Caribou Biosciences (NASDAQ:CRBU) reported fourth quarter and full year results as well as planned 2022 milestones. The company highlighted the upcoming presentation of data from the ANTLER Phase 1 clinical trial, which is evaluating the company’s multi-edited allogeneic CD19-directed CAR-T therapy in B cell non-Hodgkin lymphoma (NHL). The company also reported that it is on track to submit an IND application in 2022 for CB-011, the company’s BCMA-targeting CAR-T candidate for the treatment of multiple myeloma. Additionally, the company expects to announce target selection and perform IND-enabling studies for multiple candidates during 2022.

The company reported a cash position of $413.5 million as of December 31, which should support advancement of its wholly owned pipeline.

Verve Therapeutics

On March 14st, Verve Therapeutics (NASDAQ:VERV) reported fourth quarter and full year results as well as planned 2022 milestones. The company highlighted the advancement of its PCSK9-targeting programme (VERVE-101), for which it expects to initiate a clinical trial in the second half (H2) of 2022. Additionally, the company will initiate IND-enabling studies, also in H2, for its ANGPTL3-targeted liver programme. Moreover, without disclosing any details, the company announced that it will expand its pipeline to include additional in vivo liver gene-editing candidates, beyond its current programmes to target PCSK9 and ANGPTL3.

The company reported a cash position of $360.4 million as of December 31st, which it expects to provide cash runway into 2024.

Graphite Bio

On March 21st, Graphite Bio (NASDAQ:GRPH) reported fourth quarter and full year results as well as planned 2022 milestones. The company now plans to dose the first patient with GPH101, the company’s candidate for the treatment of sickle cell disease, in the second half of 2022. The delay comes as a consequence of the sustained impact of COVID-19 on recruitment site resources and operations.

The company reported a cash position of $378.7 million as of December 31st, which the company expects will provide enough cash to fund operations into the fourth quarter of 2024.

Poseida Therapeutics

On March 10th, Poseida Therapeutics (NASDAQ:PSTX) reported fourth quarter and full year results as well as planned 2022 milestones. Regarding its allogeneic CAR-T programmes, which utilises the Cas-CLOVER gene-editing technology, the company said that it expects to provide initial clinical data during the second half of the year. The programmes are targeting BCMA and MUC1 for the treatment of multiple myeloma and solid tumours, respectively.

The company reported a cash position of $206.3 million as of December 31st, however, the company does not provide guidance on how far this cash position will fund operations.

Precision Biosciences

On March 15th, Precision Biosciences (NASDAQ:DTIL) reported fourth quarter and full year results as well as planned 2022 milestones. The company announced that it expects to provide updates on the ongoing clinical studies with PBCAR0191, PBCAR19B, and PBCAR269A during the year. These programmes are allogeneic CAR-T cell programmes targeting CD19 and BCMA for the treatment of NHL and multiple myeloma. The company also announced that it will advance three in vivo gene-editing programmes towards IND or clinical trial application (CTA) during the next three years. The most advanced programme targets PCSK9 for the treatment of Familial Hypercholesterolemia.

The company reported a cash position of $143.7 million as of December 31st, which it expects to fund operations into mid-2023.

Cellectis

On March 3rd, Cellectis (NASDAQ:CLLS) reported fourth quarter and full year results as well as planned 2022 milestones. The company continues to recruit patients into multiple allogeneic CAR-T programmes, but did not provide guidance on when clinical updates will be announced. The company expects to file an IND application for a novel CD20xCD22 dual-targeting CAR-T programme (UCART20x22) during 2022.

The company reported a cash position of $143.7 million as of December 31, which it expects to fund operations into mid-2023.

What to look out for in April

During April, the American Association of Cancer Research (AACR) 2022 annual meeting will take place between April 8th - 13th. The conference is one of the biggest scientific conferences within the cancer field, and many companies will present their newest findings within this area. Among the gene-editing companies covered in this newsletter, CRISPR Therapeutics will present data on a pre-clinical programme utilising multiplex gene editing for a CD70-directed CAR-natural killer (NK) cell therapy.

Disclaimer: None of the information given above should be considered investment advice. The authors or CRISPR Medicine News cannot be held accountable for any losses associated with investing in the companies discussed.

Tags

ArticleNewsCMN MarketsAllogene Therapeutics, Inc.Caribou Biosciences, Inc.Cellectis S.A.Graphite Bio, Inc.Intellia Therapeutics, Inc.Poseida TherapeuticsPrecision BioSciences, Inc.Verve Therapeutics, Inc.