CMN Markets November 2021 | CRISPR Stocks and Market News

The CMN Markets Newsletter will bring you the latest news updates from the stock markets with focus on companies that have clinical-stage programmes involving a gene-editing tool like CRISPR.

Highlights

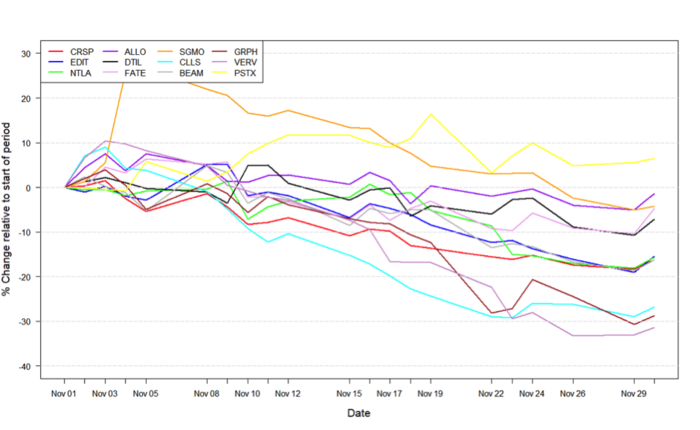

- The biotechnology sector takes a hard hit, with heavy declines in stock prices

- Financial reports submitted by multiple companies during November

- New pre-clinical data presented by Verve Therapeutics, Cellectis and Editas Medicine

Figure 1: Data on stock performance shown from November 1st to December 1st. Data from Yahoo Finance. Companies: CRISPR Therapeutics (CRSP), Allogene Therapeutics (ALLO), Sangamo Therapeutics (SGMO), Editas Medicine (EDIT), Precision Biosciences (DTIL), Cellectis (CLLS), Intellia Therapeutics (NTLA), Fate Therapeutics (FATE), Beam Therapeutics (BEAM), Verve Therapeutics (VERV), Graphite Bio (GRPH), Poseida Therapeutics (PSTX).

Influences from the broader economic trends

The stock market, and particularly the high growth stocks within the biotech sector, have been hit especially hard in November. The Federal Reserve has started changing its narrative around inflation, switching from an insistence of a transitory inflation period to a more serious tone, hinting at inflation being a bigger issue than expected. CMN Markets has covered the looming inflation issues since May of this year with comments from several respected financial analysts. To read the previous editions of CMN Markets you can click here.

While the Fed has started changing its narrative, the simultaneous report of the new and highly contagious SARS-CoV-2 Omicron variant, which appears to have emerged from South Africa, started making waves in the market this month, building fear and driving the stocks lower as it started spreading throughout the world. This drop was further substantiated as Moderna CEO Stephane Bancel told the Financial Times that “There is no world, I think, where [the effectiveness] is the same level”. This variant is again hitting biotech stocks in particular, as the market fears that a new wave of COVID-19 will shut down recruitment of patients for clinical trials, thus delaying all clinical development. This is reflected in the NASDAQ Biotechnology Index that has fallen almost 8% in the month of November.

Highlighted financial results from third quarter (Q3) of 2021

CRISPR Therapeutics

CRISPR Therapeutics (NASDAQ:CRSP) reported that clinical trials for CTX001 in beta thalassemia and sickle cell disease are ongoing, with planned regulatory submissions in late 2022. The company also reported that it will present topline results for CTX120 and CTX130, two CAR-T candidates targeting BCMA and CD70, respectively, in the first half of 2022. Finally, the company remains on track to initiate a Phase 1/2 trial of its allogeneic stem cell-derived therapy for the treatment of type 1 diabetes in 2021. The company reported a cash position of $2,477.4 million as of September 30th 2021, with a net loss for the third quarter of $127.2 million.

Editas Medicine

Editas Medicine (NASDAQ:EDIT) reported results from the third quarter and gave updates on multiple programmes. For its EDIT-101 programme for Leber Congenital Amaurosis 10 (LCA10), the company said that it remains on track to complete dosing of the adult high-dose and paediatric mid-dose cohorts in the first half of 2022. It also gave updates on EDIT-301, for which it anticipates dosing in patients with sickle cell disease during the first half of 2022. Finally, Editas announced progress in its alpha-beta T cell collaboration with Bristol Myers Squibb (BMS), with BMS having opted into an additional gene-editing programme, for a total of four, yet undisclosed, discovery programmes now being developed by the two. The company reported a cash position of $657.0 and a net loss for the third quarter of $39.1 million.

Beam Therapeutics

Beam Therapeutics (NASDAQ:BEAM) reported that the FDA has cleared its Investigational New Drug Application (IND) for BEAM-101 for the treatment of sickle cell disease (SCD). It also reported that IND-enabling studies are underway for BEAM-102, which is also being developed for SCD, although unlike BEAM-101 which is designed to reactivate foetal haemoglobin, the BEAM-102 programme uses the base-editing technology to correct the sickle causing mutation. The company reported a cash position of $933.4 million and a net loss for the third quarter of $28.1 million.

Intellia Therapeutics

Intellia Therapeutics (NASDAQ:NTLA) reported that it had initiated dosing of the fourth cohort for its NTLA-2001 programme for ATTR amyloidosis. The company expects dose expansion data in Q1 2022. Intellia also reported that it is on track to initiate first-in-human studies of NTLA-2002 for hereditary angioedema (HAE) and NTLA-5001 for acute myeloid leukaemia (AML) by year-end. The company reported a net loss of $71.6 million for the third quarter of 2021, as well as a cash position of $1,148.7 million.

Additional financial results from third quarter (Q3) of 2021

- Poseida Therapeutics (NASDAQ:PSTX), cash position $197.8 million, net loss for Q3 $42.4 million. Read more.

- Precision Biosciences (NASDAQ:DTIL), cash position $160.5 million, net loss for Q3 $11.3 million. Read more.

- Cellectis (NASDAQ:CLLS), cash position $216.0 million, net loss for Q3 $37.0 million. Read more.

- Allogene Therapeutics (NASDAQ:ALLO), cash position $861.7 million, net loss for Q3 $78.2 million. Read more.

- Fate Therapeutics (NASDAQ:FATE), cash position $803.6 million, net loss for Q3 $43.3 million. Read more.

- Sangamo Therapeutics (NASDAQ:SGMO), cash position $519.0 million, net loss for Q3 $47.7 million. Read more.

- Graphite Bio (NASDAQ:GRPH), cash position $395.0 million, net loss for Q3 $14.6 million. Read more.

- Verve Therapeutics (NASDAQ:VERV), cash position $389.2 million, net loss for $22.7 million. Read more.

- Caribou Biosciences (NASDAQ:CRBU), cash position $435.3 million, net loss for Q3 $21.0 million. Read more.

Data influencing stock movements

Intellia Therapeutics announces expansion of ongoing Phase 1 study of NTLA-2001

On the 22nd of November 2021, Intellia Therapeutics (NASDAQ:NTLA) reported that it had received approval for a protocol amendment to include adults with transthyretin amyloidosis with cardiomyopathy (ATTR-CM). So far, the study only included patients with ATTR amyloidosis with polyneuropathy (ATTRv-PN). The company now expects to enroll up to 36 patients with either hereditary ATTR-CM (ATTRv-CM) or wild-type cardiomyopathy (ATTRwt-CM).

Verve Therapeutics reports potent editing of ANGPTL3

On the 9th of November 2021, Verve Therapeutics (NASDAQ:VERV) reported positive pre-clinical results in non-human primates. The company used its proprietary GalNAc-LNP delivery platform to deliver a base-editing system to knock-out the ANGPTL3 gene. The company saw reduced blood ANGPTL3 protein of 94-97% in a model of homozygous familial hypercholesterolemia (HoFH). Verve now plans to select a development candidate for its ANGPTL3 programme and initiate investigational new drug (IND)-enabling studies in 2022. The stock of Verve Therapeutics has had a rough month, with a decline of more than 30%, despite these positive data.

Cellectis presents new in vivo pre-clinical data and expands TALEN partnership

On the 12th of November 2021, Cellectis (NASDAQ:CLLS) presented new pre-clinical data on its mesothelin-targeting CAR-T programme. The data was presented at the Annual Meeting of the Society for Immunotherapy of Cancer (SITC) and included data showing potent killing of multiple cancer cell lines in vitro and in vivo. The therapeutic candidate is the first triple knock-out candidate using the TALEN technology, with knock-outs of the TRAC, CD52 and TGFBR2 genes.

On the 18th of November 2021, Cellectis announced that it had expanded its collaboration with Cytovia Therapeutics to include new chimeric antigen receptor (CAR) targets and development in China by Cytovia’s joint venture entity, CytoLynx Therapeutics. Cellectis may receive up to a total of $805M in milestone payments as well as royalties on net sales.

Editas Medicine presents data on novel engineered IPSC-derived natural killer (NK) cells

On the 12th of November 2021, Editas Medicine (NASDAQ:EDIT) presented new pre-clinical data on its genetically-engineered iPSC-derived NK cells. The presentation included data that demonstrated efficient knock-in of a high affinity CD16 and interleukin-15 (IL-15) for enhanced anti-tumour activity and NK-cell persistence. The company used a CRISPR-Cas12a system for the knock-in, after which iPSC clones were then differentiated into iNKs. The stock price of Editas Medicine declined almost 20% during November to a 52-week low.

What to look out for in December

From December 11-14th, the 63rd ASH (American Society for Hematology) Annual Meeting & Exposition will take place. Companies such as Editas Medicine, Graphite Bio, Beam Therapeutics and Intellia Therapeutics have all submitted abstracts, and will present their findings in oral and poster presentations during the meeting. All abstracts can be found here.

Disclaimer: None of the information given above should be considered investment advice. The authors or CRISPR Medicine News cannot be held accountable for any losses associated with investing in the companies discussed.

Tags

ArticleNewsCMN MarketsAcute Myeloid Leukemia, AMLBeta ThalassemiaCancerDiabetesFamilial Hypercholesterolemia, FHHereditary angioedema, HAELeber Congenital AmaurosisSickle Cell Disease, SCDTransfusion-Dependent Beta Thalassemia, TDTTransthyretin amyloidosis, ATTRType 1 diabetesAllogene Therapeutics, Inc.Beam Therapeutics Inc.Caribou Biosciences, Inc.Cellectis S.A.CRISPR Therapeutics AGEditas Medicine, Inc.Fate Therapeutics, Inc.Graphite Bio, Inc.Intellia Therapeutics, Inc.Poseida TherapeuticsPrecision BioSciences, Inc.Sangamo Therapeutics Inc.Verve Therapeutics, Inc.